flow-through entity tax form

For calendar filers that date is March 31. Certificate of Foreign Intermediary Foreign Flow-Through Entity or Certain US.

F A S T Can Handle Llc Business Entity Development Regardless Of How Complicated Or Simple Your Business N Llc Business Annual Report Estate Planning Attorney

As part of the electronically filed Schedule 3K-1 and SK-1 forms the.

. 1 00 Schedule A Pass. Home Income Tax Pass-Through Entity Tax Pass-Through Entity Forms. 2021 Flow-Through Entity FTE annual return payments must be made timely to avoid penalty and interest.

Effective January 1 2021 the Michigan flow-through. Information about Form W-8 IMY Certificate of Foreign Intermediary Foreign Flow-Through Entity or Certain US. This section provides information on the types of investments that are considered flow-through entities and how to calculate the capital gain.

E-FIle Directly to your State for only 1499. A flow-through entity is a business entity is which income of the entity passes on to the investors or owners of the entity. 5376 on December 20.

As signed into law by Governor Whitmer on December 20 2021 PA 135 of 2021 amends the Income Tax Act to create a flow-through entity tax in. AR362 PET Election or Revocation. An owners income tax liability depends on his or her.

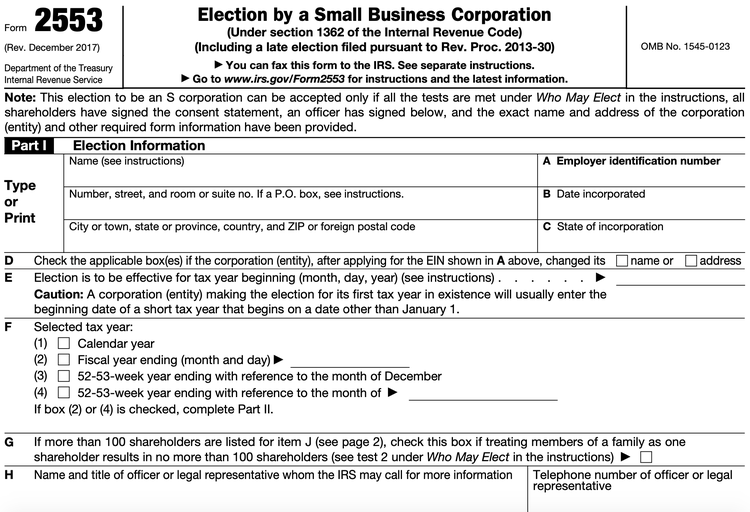

Entities can also use the Pass-Through Entity Elective Tax Payment Voucher FTB. Select the Services menu in the upper-left corner of the Account Summary homepage. October 2021 Department of the Treasury Internal Revenue Service.

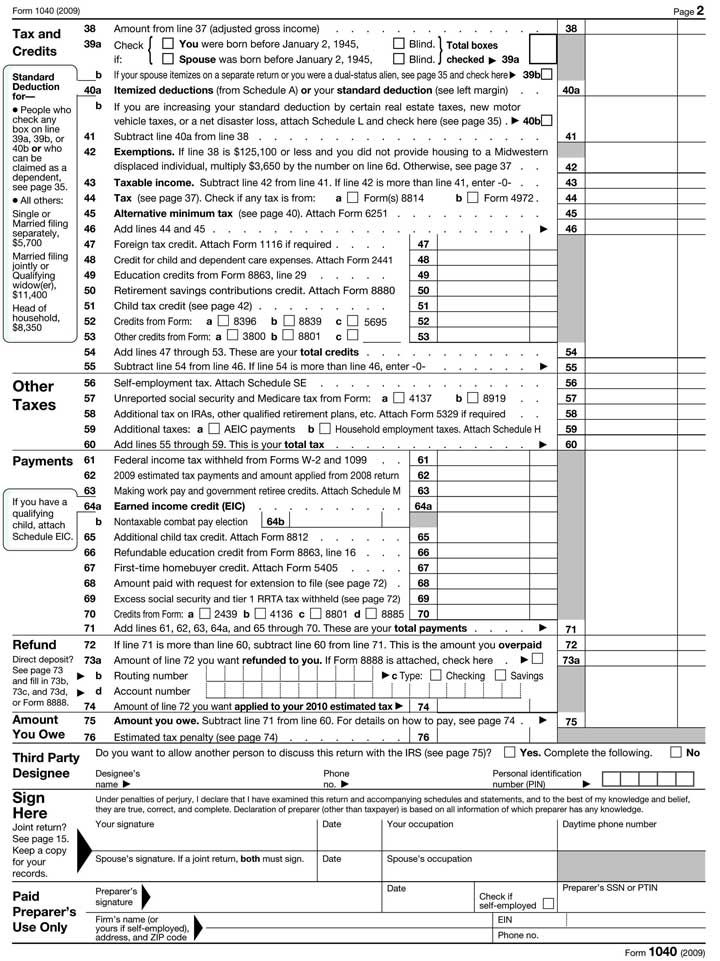

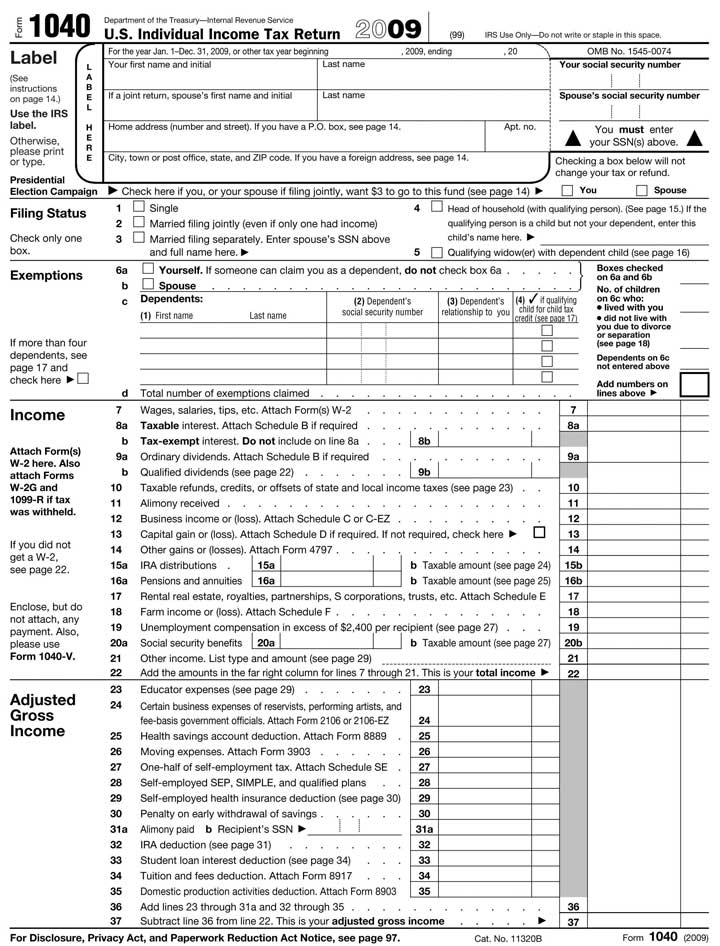

Governor Whitmer signed HB. Select Corporation tax or Partnership tax then choose PTET web file from the expanded menu. Each pass-through entity owner reports and pays tax on their share of business income on personal tax Form 1040.

With the fast approaching state tax compliance deadlines PTEs and their. Guaranteed Accurate Calculations and Maximum Refund. Branches for United States Tax Withholding provided by a foreign.

Michigan Treasury Online MTO Screenshots. A flow-through entity also known as a pass-through entity or fiscally-transparent entity is a legal business entity where its profits flow directly to the. One particular flow-through compliance concern is the existence of complex structures of related entities.

Ad 0 Federal only 1499 State. Michigan Flow-Through Entity FTE Tax Overview. Information must be filed for each member.

Flow-throughs are also a growing tax compliance concern. Entities can use Web Pay to pay for free and to ensure the payment is timely credited to their account. Calendar year 2021 has continued the trend of pass-through entity PTE tax proposals.

E-File Free Directly to the IRS. A pass-through entity that isnt exempt must file all returns electronically. Michigan Enacts Flow-Through Entity Tax as Workaround to State and Local Cap.

Apportionment Calculation and Business Income Identification. The flow-through entity tax annual return is required to be filed by the last day of the third month after the end of the taxpayers tax year. Income From Pass Through Entities.

The Form W-8IMY Certificate of Foreign Intermediary Foreign Flow-Through Entity or Certain US. Pass Through entities must provide to its entity owners a Schedule RK-1 and NRK-1 detailing the entity owners share of pass through income and losses. The flow-through entity tax will be imposed on the entitys allocated or apportioned positive business income tax base at the same rate as the individual income tax currently 425.

February 03 2022 State Local Tax. The pass-through entity will pay tax at a rate of 93 on the total of each consenting owners pro-rata or distributive share of income subject to California personal income tax beginning at. 01 April 2021.

2021 PA 135 introduces Chapter 20 within Part 4 of the Michigan Income Tax Act. Flow-Through Entity FTE Tax Return Form 5772. Branches for United States Tax Withholding and.

However the late filing of 2021 FTE returns will be accepted as timely if filed within 6 months of the due date. In this legal entity income flows through to the owners. 653001210094 Department of Taxation and Finance IT-653 Pass-Through Entity Tax Credit Tax Law Section 606kkk 1Add column C amounts see instructions.

How To Start An Llc In Nevada Llc Business Annual Report Estate Planning Attorney

The U S Federal Income Tax Process

Form C S Is An Abridged 3 Page Income Tax Returns Form For Eligible Small Companies To Report Their I Business Infographic Singapore Business Income Tax Return

:max_bytes(150000):strip_icc()/10402021-4522fd0d0a6d4ce392d3fd952db762fd.jpeg)

Form 1040 U S Individual Tax Return Definition

:max_bytes(150000):strip_icc()/1065-4a7e2e6cd377480d8309bf645bfc20a4.jpg)

Form 1065 U S Return Of Partnership Income Definition

The U S Federal Income Tax Process

Schedule K 1 Tax Form Here S What You Need To Know Lendingtree

Man Makes Ridiculously Complicated Chart To Find Out Who Owns His Mortgage Chart Flow Chart Chart How To Find Out

Understanding The 1065 Form Scalefactor

Infographic Corporation Vs Llc Accounting Classes Business Entrepreneurship Class

How To Fill Out Form 1065 Overview And Instructions Bench Accounting

Form 12 12a Five Ways On How To Prepare For Form 12 12a Federal Income Tax Tax Forms Irs Taxes

Dpdf19 Bizfilings 5 Steps To Forming Entity Infographic Business Owner Infographic Operations Management

Fy 19 20 Income Tax Return E Filing Exemptions Deductions E Payment Refund And Excel Calculator Only 30 Second Income Tax Return Income Tax Tax Return

:max_bytes(150000):strip_icc()/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

Form 1120 S U S Income Tax Return For An S Corporation Definition

Complying With New Schedules K 2 And K 3

:max_bytes(150000):strip_icc()/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

Form 709 United States Gift And Generation Skipping Transfer Tax Return

Form 12 12a Five Ways On How To Prepare For Form 12 12a Federal Income Tax Tax Forms Irs Taxes